Master Private Equity Recruiting

Modeling, case studies, and everything you need to break into a top fund.

Check out a free preview.

Created by Experts from the Top Institutions

STEP 1

Study Comprehensive LBO Model Tests

Three-statement LBO models used by the top funds covering everything you need to know: purchase accounting, operating builds, dividend recaps, add-on acquisitions, OID, and more.

STEP 2

Watch Video and Excel Tutorials

Over 100+ comprehensive videos covering hours of private equity modeling and recruiting - Excel included!

STEP 3

Practice with Case Studies from Top Funds

Real case studies and technical questions used by mega funds and the very best private equity firms during on-cycle recruiting.

On-cycle private equity recruiting is perhaps the most chaotic and opaque hiring process in all of finance. The process is so accelerated that it is often the most prepared candidates who end up landing the top mega fund jobs.

We've aggregated the best interview questions, models, and case studies from across the industry and put them into one simple resource.

Our Students Get the Top Offers

5 3-Statement LBO Model Tests

of increasing difficulty, designed to teach you how to model complex mechanics and structures (operating model, PIK interest, minority investments, dividend recap, add-on acquisitions).

7 Paper LBO Model Tests

based on actual questions we were asked during on-cycle recruiting. Very frequently asked during rushed processes!

100+ Videos with 11+ Hours of Content

that break down EVERY concept you need to know in detail. Do the entire course in a couple of weekends and be ready for your private equity super days in no time.

2025 Headhunter Coverage List

outlining a list of the major North American private equity headhunters and which firms they represent.

9+ Case Studies Used by Mega Funds

including a step-by-step video tutorial on how to write a case study memo and build an LBO with just a 10-K.

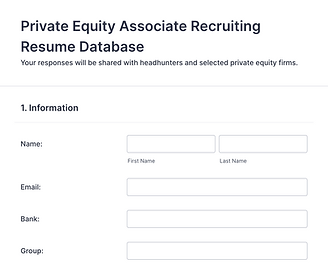

Exclusive Resume Database for On-Cycle Recruiting

reviewed by all the top North American private equity headhunters. We collect resumes before the beginning of each cycle and provide headhunters with a database of our students.

200+ Page Recruiting Guide, 50+ Page Q&A Guide and Quizzes

filled with tips, tricks, and the most common questions asked by the top private equity firms. We give you the Excel behind every question so you make sure you know the mechanics!

Private Equity Concepts Explained by an Industry Expert

covering free cash flow yield, unit economics modeling, operating leverage and the ins and outs of the recruiting process.

Be Prepared When Recruiting Kicks Off

Earn the Private Equity Certificate

The Peak Frameworks brand is recognized in the private equity world and has helped candidates distinguish themselves during recruiting.

The Peak Frameworks Private Equity Certificate communicates to private equity firms and headhunters that you can build LBO models and analyze investments.

The certificate can be included on your resume or LinkedIn and its authenticity will be verified by our team.

Enroll in the Private Equity Resume Database

We collect resumes from our candidates going through private equity recruiting and compile them into a database.

The top North American recruiters and many private equity firms access our database to help filter and evaluate candidates.

Note: The resume deadline for Winter 2026 has closed. The next resume drop will be in Summer 2026.

Private Equity Course

limited one-time price of

$497

(>15% off the standard price of $599)

This course has been purchased by thousands of candidates pursuing on-cycle and off-cycle recruiting and has an average rating of 5 stars.

Our Students Get the Top Offers

Mega Fund Private Equity Placement

I'm Matt Ting, the Course Director of Peak Frameworks.

I've spent my career working at the top private equity funds and was a top bucket analyst at a leading investment bank. I've worked at Silver Lake Partners, Providence Equity and Evercore in New York and Silicon Valley and received offers from several other investment firms.

I know exactly how tough the struggle is - I come from an international school and had to grind tooth and nail to get looks at those firms.