The Complete Finance Framework

6 courses to take you from complete beginner to investment professional.

Ensure you're on the best path possible with our Excel models and recruiting guides.

Created by Experts from the Best Institutions

Take the Stress Out of Recruiting

1

Start Your Career at a Top-Tier Investment Bank

-

Get into a bulge bracket or elite boutique from any school by studying the right interview questions, model exercises, and technical concepts.

Be Prepared Every Step of Your Career

6 Comprehensive Courses Made by Finance Professionals

that will optimize your path from complete beginner to investor at a top fund. Start at a top-tier investment bank and move into a top private equity firm or hedge fund.

550+ Videos with 50+ Hours of Content

simply explaining every concept, model, and question you need to know for your interviews. Our concise videos and Excel tests will prepare you as efficiently as possible.

LBO, Public Company Models, and Accretion/Dilution Analysis

based on our work experience at top private equity funds, hedge funds, and investment banks. Feel confident for every case study and technical question you could get.

Sample Stock Pitches, Investment Memos, and Interview Questions

that dramatically reduce your interview prep time. Study with our library of hundreds of interview questions and Excel examples.

The Complete Finance Framework

limited one-time price of

$1,347

(~20% less than if you bought each course separately)

Our courses have been used by thousands of candidates to break into investment banking, private equity, and hedge funds and have an average rating of 5 stars.

Distinguish Yourself with a Certificate

The Peak Frameworks brand is recognized in the corporate finance world and has helped candidates distinguish themselves during recruiting.

We offer certificates for our Private Equity, Hedge Fund, Investment Banking, Valuation & Finance, and Equity Research courses, which are all included in this bundle.

These certificates can be included on your resume or LinkedIn and its authenticity will be verified by our team.

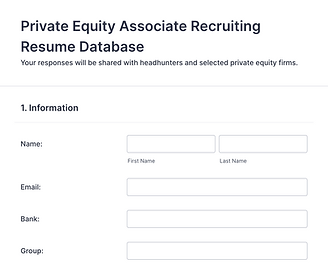

Enroll in Our Buyside Resume Databases

We collect resumes from our candidates going through private equity and hedge fund recruiting and compile them into a database.

The top North American recruiters and many investment firms access our databases to help filter and evaluate candidates.

Note: The resume deadline for Winter 2026 has closed. The next resume drop will be in Summer 2026.

Our Students Get the Top Offers

Our Students Get the Best Placements

I'm Matt Ting, the Course Director of Peak Frameworks.

I've spent my career working at the top private equity funds and was a top bucket analyst at a leading investment bank. I've worked at Silver Lake Partners, Providence Equity and Evercore in New York and Silicon Valley and received offers from several other investment firms.

Subscribe for Free Business and Finance Resources

Get Everything Here for a One-Time Fee

Private

Equity

-

LBO model tests and case studies

-

Preferred securities, PIK debt, convertibles

Investment

Banking

Valuation

& Excel

Hedge

Fund

Resume

& Cover Letter

-

Public company models

-

How to build a compelling stock pitch

-

Investment memos

-

Accretion, dilution & accounting flowthrough

-

Valuation models (DCF, comps)

-

Corporate finance fundamentals

-

Excel and PowerPoint training

-

My resumes and cover letters from PE, IB, and school

Equity

Research

-

How to write

a research report -

Public company models